Written by Lyubomir Hadjiyski

John (Iannis) Mourmouras is Deputy Governor of the Bank of Greece with responsibilities pertaining to the implementation of monetary policy, global capital markets, payment and settlement systems, and bank resolution. He is also Chairman of the Bank’s Financial Asset Management Committee. He served as Deputy Finance Minister of Greece (2011-2012) and was Chief Economic Advisor to the Greek Prime Minister, as well as Head of the Prime Minister’s Economic Office (2012-2014). He is Professor of Macroeconomics at the Department of Economics, University of Macedonia – Thessaloniki, Greece, and has previously held academic positions at a number of British universities. He holds a PhD from the University of London and is a graduate of the London School of Economics (LSE).

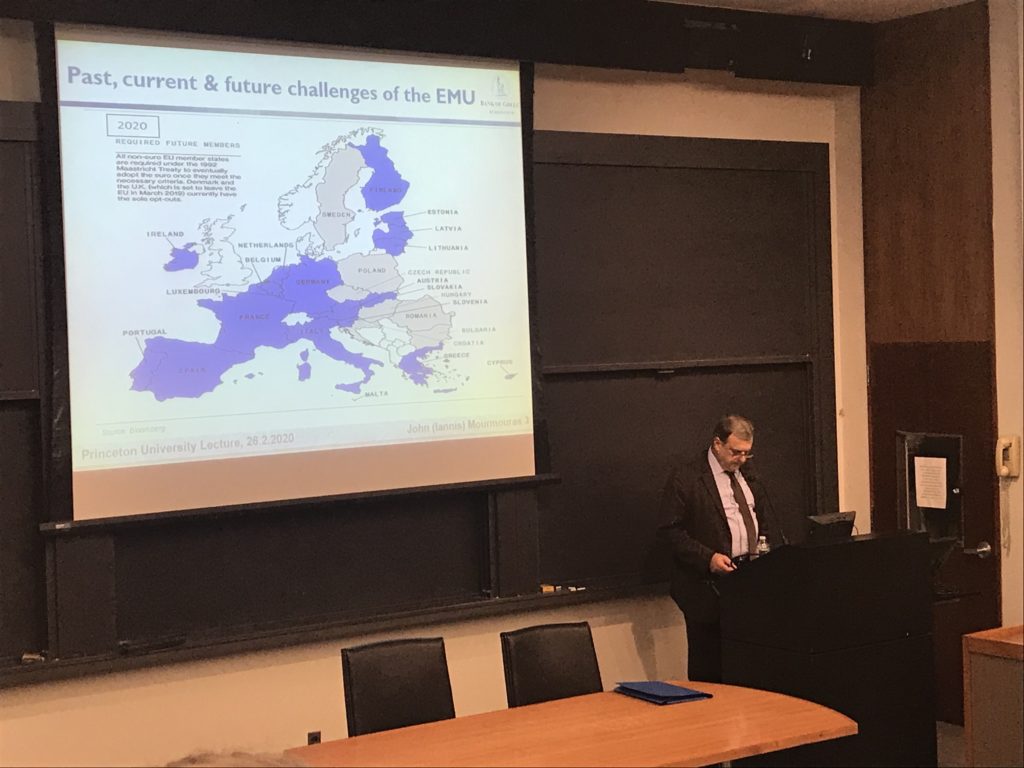

John Mourmouras spoke to Princeton students and faculty today on the topic of the Euro — the common currency of the European Union. He highlighted the currency’s achievements and drawbacks in the 21 years since its implementation, and his predictions for the opportunities and challenges that lie ahead.

The two decades of the Euro can roughly be split into two, each with its own distinct characteristics. The first, from the introduction of the currency in 1999, ended in 2008 with the global financial crisis. During this time, the Euro emerged as the world’s second reserve currency behind the US Dollar — a position it still holds today. The second period, from 2009 to 2019, was marked by ten years of European economic turmoil that hit Southern countries particularily hard. During this time, four EU member countries participated in EU bailout programs — included Greece, Portugal and Cyprus — while the European Central Bank (ECB) engaged in unconventional monetary policy like setting negative interest rates and engaging in quantitative easing.

However, the North-South divergence existed far before the Eurozone crisis. In the ten years after the 1999 introduction of the Euro, North European countries saw, on average, a 30% increase in their GDPs. For Southern Europe, this number was closer to 10%. Indeed, the split between the North and South appears to be chronic, and largely due to three reasons. The first is historic differences in unemployment rates: while some countries like Spain have a long-term unemployment rate of 12%, most Scandinavian countries hover around 5%. This means that potential output is lost in Southern European countries. Second, labor and total factor productivity is significantly lower in the South. Third, asymmetries in incomes have arisen due to lower wages and stricter austerity measures in the South, which has also impacted consumption. All in all, the North-South divide has widened since 2009, which poses a substantial challenge to the unity of the EU.

There are several lessons to be learned from the Eurozone crisis, the most important of which is that the sovereign debt crisis was not inevitable: the existence of a common fiscal authority (in addition to the common monetary authority in the face of the ECB) would have lessened the impact of the crisis by formulating a common fiscal response in both prior and after the Eurozone crisis. National governments failed to use fiscal and other policies to manage the credit boom of the early 2000s, and subsequently relied on excessive austerity to manage the crisis. Further, the ECB was too slow in moving towards unconventional policies like quantitative easing, all of which prolonged recession.

There are several challenges that lie ahead. Among the greatest are what role, if any, the ECB will take with regards to Climate Change. While some, including ECB President Lagarde, argue for an active role, the question remains whether this is within the purview of the institution. Second, the emerge of digital currencies will bring multiple difficulties and opportunities, and Central Banks all over the world will have to contend with tech giants and corporations that control these alternative currencies. Finally, Europe’s populist wave may threaten both the unity of the bloc and the ability of the ECB to make independent, technocratic decisions; the prospect of politicizing the institution is real and dangerous.

The Euro’s 21-year history has been eventful. However, Mourmouras argued that this is the natural evolution of monetary unions — after all, the United States only established its Federal Reserve more than 100 years after independence. The Euro is a global currency: it remained strong throughout the debt crisis and is here to stay. Whether it will overtake the US dollar, continue to be the world’s second reserve currency, or lose this title to the Yuan depends on political will and smart policy.